Popular Posts

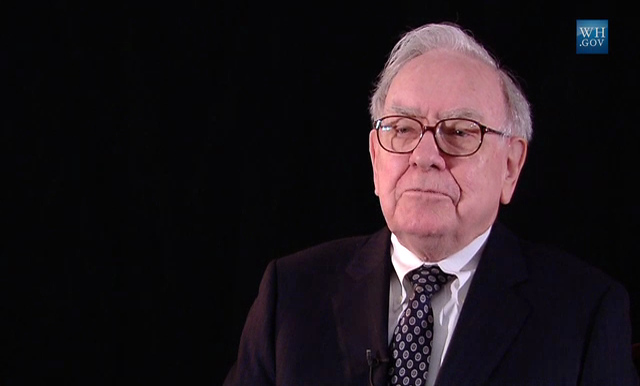

Can you invest like Warren Buffett, the iconic billionaire investor?

Buffett has one simple rule for making money with investments.

“Be fearful when others are greedy, and be greedy when others are fearful,” he wrote as the stock market plummeted 10 years ago, during the credit crisis.

You might think, well, easy for him to say. He’s already a billionaire.

But it is easy to invest the Buffett way. Doing a few simple things the right away mean you too can benefit — even in a bear market.

A lot of folks conclude from the quote above that the goal is to buy and sell at the right moments, to time the market correctly.

Buy when prices are low but sell when prices are high.

It is, nevertheless, nearly impossible to know when prices are high, or when they are low and will go no lower.

It is disconcertingly easy to sit in cash as the market inexorably rises. Or to hold on to investments as they fall, only to sell at rock bottom.

That, of course, is selling high and buying low — the opposite of Buffett’s advice.

So how can an ordinary investor invest like Warren Buffett: Dollar-cost averaging and diversification.

Dollar-cost averaging just means making substantially similar-size investments all year along. That could be monthly, quarterly, weekly — whatever fits your budget and temperament.

Making the same investments all year long in dollar size means you buy more shares when prices are lower and fewer shares when prices are higher, automatically.

That’s buying more stocks at a low and less when they are high, a big step toward the Buffett way.

Diversification is just owning a broad variety of investments. Say, by owning the S&P 500 Index through an index fund, or a bond index fund which owns the entire bond market.

Diversification greatly reduces the emotions around investing. Sure, one stock or another might be skyrocketing higher, but you won’t feel exposed to the risk of a reversal.

You own that stock, but it’s only a small percentage of your total investments.

When individual stocks fall, likewise, you aren’t exposed to those individual declines a big way.

Meanwhile, your steady contributions buy more of the declining stocks and less of the rising stocks, automatically.

The real game for an investor such as Buffett is capturing the awesome power of compounding.

Investment gains not taken as income are reinvested automatically thanks to rebalancing in a diversified portfolio.

Likewise, interest and dividend income is reinvested, too.

That’s buying low automatically. The long-term trend for stocks has been to outpace inflation handily.

The compounding effect increases the value of your investments with no additional saving necessary. In time, your portfolio is worth far more than your total contributions, thanks to reinvestment and growth.

No need to be fearful or greedy, just patient and disciplined as you invest for the long term.

MarketRiders, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.