Popular Posts

What’s the greatest risk to your investments and, ultimately, your retirement: A market crash? Economic calamity?

No, it’s selling your investments once a market crash is under way.

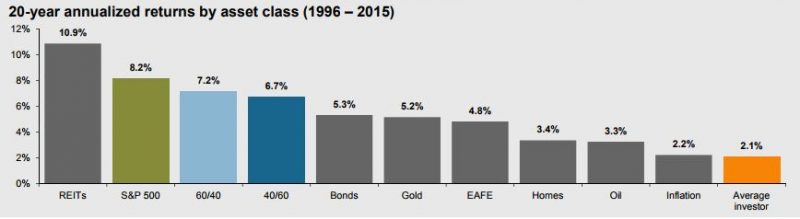

The data on long-term investment performance is hard to ignore. JP Morgan, the investment bank, regularly updates a simple chart that shows how different investment classes have performed.

It’s easy to focus on the clear winner in the recent past, such as real estate investments and the broad stock market.

But that’s why the bank used the color orange to point out the lowest performer — the individual investor.

Shockingly, ordinary people actually lost money investing, turning in a 20-year annualized performance lower than inflation!

That’s pretty hard to do, all things considered. The 2.1% compared to inflation of 2.2% means that the cash they invested is literally worth less than before.

The small investor could have bought gold and done better, essentially more than double the inflation rate at 5.2% annualized return. But take a look at the green bar, which is the S&P 500 return, best represented as an index fund return.

An 8.2% return is very good over 20 years. A $10,000 investment in gold grew to $27,562 over those decades. Thanks to reinvested dividends and interest and appreciation, the stock investment grew to $48,367.

Now, a lot of people should not make a straight stock investment. There are periods when the stock market declines overall, such as 2008, and owning other investments can soften the blow.

That’s why the bank included the blue bar, which shows the return of a portfolio that is 60% stocks and 40% bonds. At 7.2%, that investment turned $10,000 into $40,169 over the 20-year period.

Nobody knows what the next 20 years holds, but the simple fact is that over long periods the stock market soundly beats inflation, bonds, gold and cash. And it absolutely wallops the small investor trying to pick stocks.

The way to protect yourself from inflation, and from yourself, is to own the stock market in a portfolio. Whether that portfolio is all stocks, mostly stocks or some mixture of stocks and bonds is a matter of your own tolerance for risk.

What would happen to your outlook if the stock market declined by 20%? If your answer is “nothing good,” then you probably should own at least some bonds.

The declines will still happen, but your portfolio won’t take the brunt of it. In fact, as the stock market falls, you can use savings and bond interest payments to buy more while prices are lower. Index investing is the cheapest, most reliable way to do this.

Likewise, when stocks climb, you can sell off excess stock gains and reinvest into bonds, real estate and other asset classes that are relatively cheap. That’s selling high to buy low.

Prudent portfolio management will nudge your return toward a final annualized figure close to the stock market itself but with far less risk involved.

Most importantly, you won’t be the average investor who spends 20 years buying and selling, only to turn $10,000 into $15,154 and then realize that inflation has eclipsed even that meager gain.

MarketRiders, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.