Popular Posts

If you’ve ever hiked up a mountain you know how elusive the summit can be.

As you rise to a high point it seems like the peak, the end of the hike. Then you look over the hilltop and realize there’s miles to go. The height you’ve reached only gives you a better look at the climb ahead, so you keep walking.

Another false summit, another view of the hike to come. So on and so on until you finally stumble across a small metal marker on the ground that tells you there is no more “up” from here.

Often, rather than appearing on a jagged point in the sky the marker sits on flat ground, barely distinguishable from any spot nearby.

Yet that’s it. You’ve hit the highest point, or at least the highest point on that particular hill. Time to take a break, maybe a few pictures.

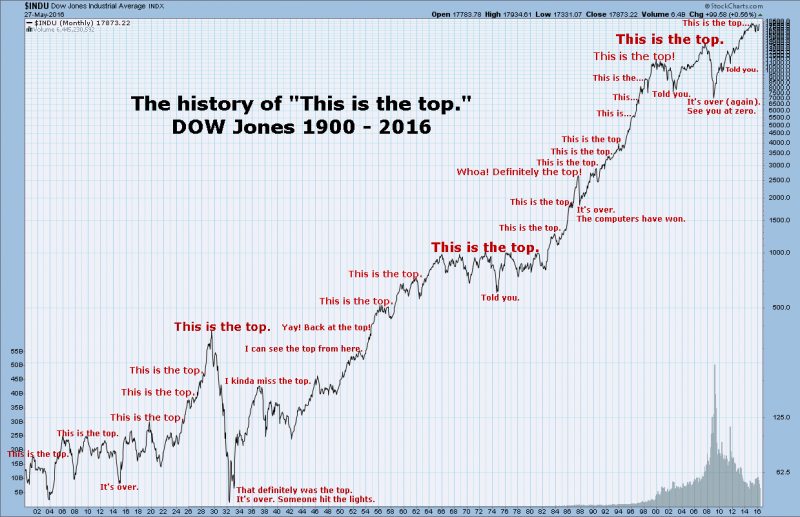

Stock market “tops” are lot like those metal markers. A point in time but by no means the top of anything real.

Many stock market pundits are using up cheap Internet bandwidth in an effort to pick the newest stock market top. Good luck to them.

Mostly, this is the natural result of concern over the new administration in Washington. Stocks have been a tear recently, setting new highs every day.

Every day seems like a peak, the top. Then the next day proves that conclusion wrong. Why does this happen? How could it just keep going on?

It happens because the stock market recalibrates in real time according to earnings, inflation and interest rates.

Earnings dictate investor demand. So long as corporate earnings grow steadily, so will demand to participate in that earnings growth. Stock prices rise and dividend payments often rise, too.

Inflation is what drives earnings. Companies must be profitable after inflation or they risk going out of business. This forces management to make prudent decisions regarding business growth and investment.

Interest rates, in turn, either promote growth or slow it down. If inflation creeps higher, the Federal Reserve is likely to try to slow growth by making money more expensive.

If inflation is low — the experience of the last several years in many national economies — interest rates are relaxed to support business.

Just to complicate matters, throw into the mix unemployment data, personal income, household spending, credit cycles, trade and currency trends. It’s a very complex and delicate equation, one even great policymakers and investors can misread.

But the bottom line remains this: Companies must grow to offset inflation. That’s why stocks over the long-term beat inflation, especially when investors reinvest their dividends.

That’s also why finding the “top” of a stock market is a meaningless exercise, and one prone to cause investor heartache. Going to cash means losing out on that growth forever.

The better approach is stay invested and adjust your portfolio for risk by diversifying into non-stock holdings, such as bonds and real estate. Rather than sitting out the next climb, rebalance as needed and keep climbing.

MarketRiders, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.