Popular Posts

It seems like 99% of the financial pages on the Internet are devoted to a single idea — that you can beat the market just by owning the right stocks at the right times.

That’s great marketing, I suppose. It’s action-oriented (do something!), specific (buy this stock now!) and utterly unfalsifiable. Nobody knows if a given stock will go up or down, so it can’t be proven that it won’t go up.

But flip that logic for a second. It also can’t be proven that the stock won’t go down instead. Investing history is littered with companies that lost market value and never, ever recovered. They just went out of business. It happens to a lot of “hot” investments.

A much larger number of companies have a moment in the sun and, years later, find their fortunes revived by chance, good management or both. The problem is, you spent a long, long time in that investment earning nothing — no dividends, no price appreciation.

Would you, could you hold on to a single stock in a large enough concentration to matter to your portfolio through a decade of poor returns? Probably not. In fact, the much more likely outcome is that you will wait until the stock hits its lowest point and then sell, locking in the loss forever.

Or the reverse, you buy a stock as it hits its all-time high point. From there, it’s often all downhill for a long, long time.

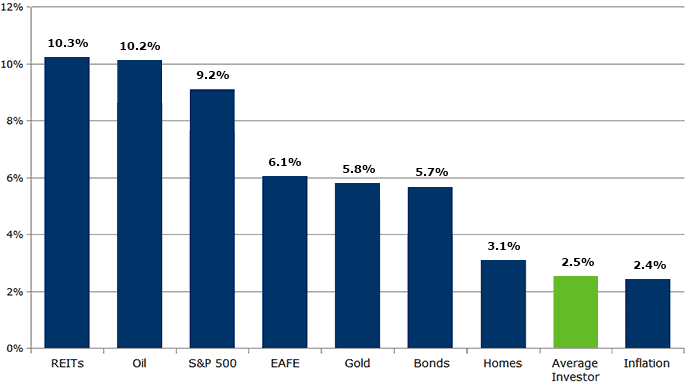

It’s for this reason that individual investors do so poorly, earning 2.5% compared to more than 9.2% for the S&P 500 over the 20-year period ending in 2013. Our brain tells us to buy what has gone up and sell what has gone down.

In fact, it’s the other way around. We should be selling the gainers in order to buy more of the relative “losers.” That’s portfolio management by rebalancing, a standard practice among the world’s top endowments and pension funds.

As for the time aspect, that’s the key. Don’t wait for the “right moment” to buy. Instead, own the market all the time through a well-designed portfolio that includes stocks, bonds, real estate and foreign assets.

Rebalancing with discipline over long periods will bring you a stock-like return without the stock-like risk involved in owning just the S&P 500. You are more likely to stay in during down markets and more able to capture the upsides of strong recoveries.

More importantly, you will in time begin to accept the truth about all those Internet headlines telling to take action now — it’s a mistake. Rather, you are taking action prudently by staying invested in a risk-adjusted way. It’s your investing secret weapon: patience and avoiding emotional mistakes.