Popular Posts

New data from Morningstar, the mutual fund research firm, recently noted that mutual funds have increased their holdings of exchange-traded funds (ETFs) dramatically.

How dramatic? In 2006, just 595 funds held ETFs, at 1.2% of assets. Ten years later, the figure was 1,222 funds and 4.5% of assets.

That might not sound like much, but consider that the universe is about 9,000 funds and $15.7 trillion in assets.

It breaks down to nearly 14% of funds owning ETFs and those median holdings being worth $706.5 billion.

So what? Ostensibly, the reason investors buy mutual funds at all is because the managers of those funds promise to outperform the stock market. Increasing ownership of index funds via ETFs is essentially an admission of failure by active managers charging a fee.

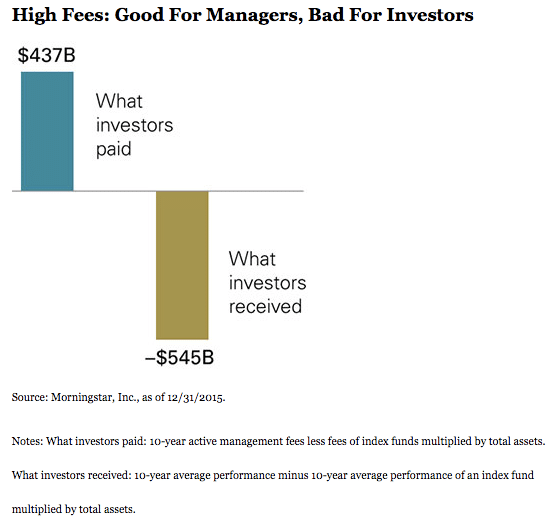

Meanwhile, a separate Morningstar study found that over 10 years ending in 2015, mutual fund managers produced returns $545 billion below the market index.

Nevertheless, those same managers earned $437 billion in fees for that sorry performance.

Ultimately, you have to wonder why actively managed mutual funds exist at all, but the free market is the free market. If investors want to pay a manager to try to beat the overall market index return, they are free to do so.

Investors also are free to bypass management and own ETFs themselves, which is exactly what is happening.

According to The New York Times, investors put $823 billion into funds run by passive investing giant Vanguard in the past three years. During the same period, the remainder of the mutual fund industry, some 4,000 firms, took in just $97 billion.

Investors increasingly are voting with their feet. The odd thing is, so are the mutual fund managers themselves. Active managers promise to “do something” to earn their fees but that something looks more and more like just owning the market.

What can you do as a long-term retirement investor?

First, be very suspicious of funds promising that active management is the answer. The data, gathered over decades, shows that it is not. Rather, the answer is to earn the market return at the lowest cost, while adjusting your portfolio for risk.

Second, save more. The days of relying on double-digit stock market returns to make up ground are probably behind us. Nobody knows what the markets will do in the future, but failing to save is betting on easy, low-hanging fruit that might not appear.

Finally, consider seriously whether you have the discipline to invest and rebalance index funds on your own. If the answer is a clear “yes,” self-directed IRA investing is the way to lower costs and create a retirement investing plan that really works.

MarketRiders, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.